What Does The Tax Status Mean . answer a few questions to find your right filing status. If the taxpayer is required to file a federal tax return. your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. Typically, your tax return filing status depends on if you’re. How filing status affects your tax. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. Choosing the right one is crucial because it. when preparing and filing a tax return, the filing status affects:

from solvetaxproblem.in

when preparing and filing a tax return, the filing status affects: If the taxpayer is required to file a federal tax return. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. How filing status affects your tax. Choosing the right one is crucial because it. answer a few questions to find your right filing status. Typically, your tax return filing status depends on if you’re. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct.

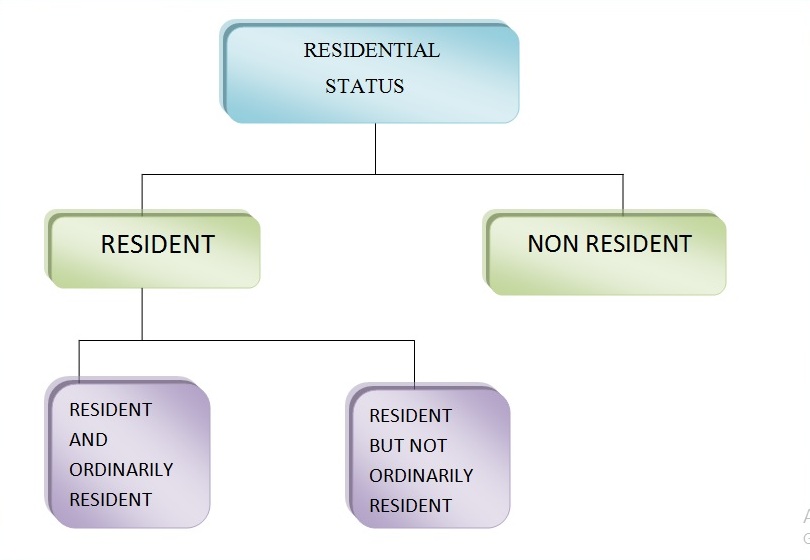

How to determine Residential Status for Tax purpose Solve Tax

What Does The Tax Status Mean How filing status affects your tax. Typically, your tax return filing status depends on if you’re. Choosing the right one is crucial because it. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. when preparing and filing a tax return, the filing status affects: your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. If the taxpayer is required to file a federal tax return. How filing status affects your tax. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. answer a few questions to find your right filing status.

From federal-withholding-tables.net

2021 Us Federal Tax Tables Federal Withholding Tables 2021 What Does The Tax Status Mean answer a few questions to find your right filing status. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. How filing status affects your tax. Choosing the right one is crucial because it. Typically, your tax return filing status depends on if you’re. If the taxpayer is required to file. What Does The Tax Status Mean.

From support.taxaj.com

Guide to Check Tax Return Status What Does The Tax Status Mean How filing status affects your tax. Typically, your tax return filing status depends on if you’re. Choosing the right one is crucial because it. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. your income tax filing status informs the internal revenue service (irs) about you and your. What Does The Tax Status Mean.

From blog.hubcfo.com

Tax Filing Status and Exemptions What Does The Tax Status Mean your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. answer a few questions to find your right filing status. If the taxpayer is required to. What Does The Tax Status Mean.

From www.youtube.com

tax return status 2021 22 tax refund ITR processed What Does The Tax Status Mean answer a few questions to find your right filing status. If the taxpayer is required to file a federal tax return. your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. when you file your federal income tax return, one of the first decisions you need to make. What Does The Tax Status Mean.

From www.elidge.com

What various status of tax returns mean Easy Guide 2024 Easy Guide What Does The Tax Status Mean Typically, your tax return filing status depends on if you’re. answer a few questions to find your right filing status. when preparing and filing a tax return, the filing status affects: How filing status affects your tax. when you file your federal income tax return, one of the first decisions you need to make is selecting your. What Does The Tax Status Mean.

From www.jaldennis.com

Choosing the correct tax filing status and what they actually mean. What Does The Tax Status Mean your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. Typically, your tax return filing status depends on if you’re. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. answer a few questions to find your right filing status. Choosing. What Does The Tax Status Mean.

From www.youtube.com

How to Determine the Residential Status for Tax? YouTube What Does The Tax Status Mean Typically, your tax return filing status depends on if you’re. when preparing and filing a tax return, the filing status affects: answer a few questions to find your right filing status. Choosing the right one is crucial because it. when you file your federal income tax return, one of the first decisions you need to make is. What Does The Tax Status Mean.

From economictimes.indiatimes.com

ITR filing status How to check tax return status Check ITR What Does The Tax Status Mean answer a few questions to find your right filing status. Typically, your tax return filing status depends on if you’re. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. when you file your federal income tax return, one of the first decisions you need to make is selecting your. What Does The Tax Status Mean.

From cleartax.in

Tax Refund Status How to check ITR Status Online? What Does The Tax Status Mean when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. Typically, your tax return filing status depends on if you’re. How filing status affects your tax. Choosing the right one is crucial because it. your tax filing status helps the irs determine your filing requirements, standard. What Does The Tax Status Mean.

From www.wikihow.com

3 Ways to Determine Your Tax Filing Status wikiHow What Does The Tax Status Mean your income tax filing status informs the internal revenue service (irs) about you and your tax situation. when preparing and filing a tax return, the filing status affects: How filing status affects your tax. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. Choosing the right one. What Does The Tax Status Mean.

From www.wikihow.com

3 Ways to Determine Your Tax Filing Status wikiHow What Does The Tax Status Mean answer a few questions to find your right filing status. How filing status affects your tax. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status.. What Does The Tax Status Mean.

From support.taxaj.com

Guide to Check Tax Return Status What Does The Tax Status Mean your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. If the taxpayer is required to file a federal tax return. answer a few questions to find your right filing status. when you file your federal income tax return, one of the first decisions you need to make. What Does The Tax Status Mean.

From www.jdtaxaccounting.com

What is the TaxExempt Status? JD Tax and Accounting Advisors What Does The Tax Status Mean Typically, your tax return filing status depends on if you’re. your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. How filing status affects your tax. when preparing and. What Does The Tax Status Mean.

From ideatax.id

Everything You Need to Know about Tax Return Status What Does The Tax Status Mean your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. answer a few questions to find your right filing status. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. your income tax filing status. What Does The Tax Status Mean.

From jfwaccountingservices.cpa

6 things you need to know about your Nonprofit’s Tax exempt status What Does The Tax Status Mean Typically, your tax return filing status depends on if you’re. answer a few questions to find your right filing status. when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. when preparing and filing a tax return, the filing status affects: your filing status. What Does The Tax Status Mean.

From www.goldenappleagencyinc.com

5 Types of Filing Status for Taxes Explained What Does The Tax Status Mean answer a few questions to find your right filing status. your income tax filing status informs the internal revenue service (irs) about you and your tax situation. your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. How filing status affects your tax. If the taxpayer is required. What Does The Tax Status Mean.

From solvetaxproblem.in

How to determine Residential Status for Tax purpose Solve Tax What Does The Tax Status Mean when you file your federal income tax return, one of the first decisions you need to make is selecting your filing status. Choosing the right one is crucial because it. your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct. your tax filing status helps the irs determine. What Does The Tax Status Mean.

From summitfc.net

Tax Filing Status Options A Guide to Selecting the Right One What Does The Tax Status Mean when preparing and filing a tax return, the filing status affects: your tax filing status helps the irs determine your filing requirements, standard deduction, eligibility for tax credits, and correct. How filing status affects your tax. answer a few questions to find your right filing status. when you file your federal income tax return, one of. What Does The Tax Status Mean.